Capital Allocation

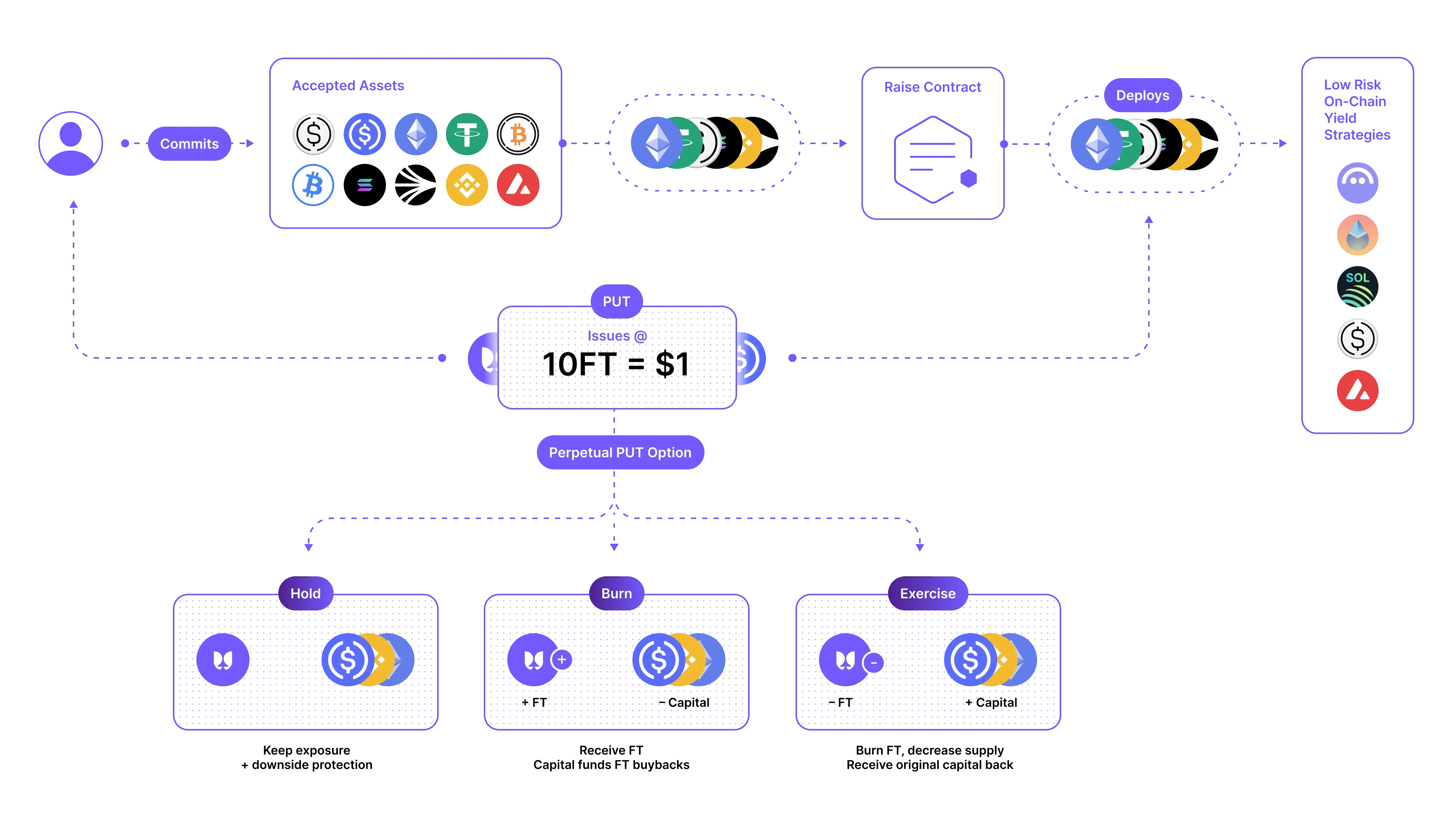

Flying Tulip is opening its raise to the public to broaden participation in the project’s financing. This follows our $200 million private round and sets the stage for a transparent, on-chain program that’s straightforward and fully auditable.

What You Get to Start

Commit $1 in capital: Receive 10 FT1

Fixed Supply, No Inflation

FT has a maximum supply of 10 billion, minted at deployment. Capital AllocationCapital AllocationThe on-chain Public Sale event where contributors exchange accepted assets for FT at a fixed rate (10 FT per $1). FT is allocated from a fixed pre-minted total supply of 10B. totalSupply stays 10B while the split between circulating and non-circulating supply changes.View glossary entryCapital AllocationThe on-chain Public Sale event where contributors exchange accepted assets for FT at a fixed rate (10 FT per $1). FT is allocated from a fixed pre-minted total supply of 10B. totalSupply stays 10B while the split between circulating and non-circulating supply changes.View glossary entry distributes FT at 10 FT per 1 committed (implied \0.10) from this fixed supply. If $500m is committed, 5B FT are allocated, and the remaining 5B FT stay in the Investment Contract (Perpetual PUT reserve) as non-circulating supply. totalSupply stays at 10B, only the split between circulating and non-circulating supply changes. There is no vesting, no future inflation, and no additional minting.

Contributions are made through flyingtulip.com and settle to the Investment Contract.

Note: The address for the Investment Contract will be finalized in‑app. Always verify the address shown in the InvestInvestDeposit accepted assets to open a PUT position and withdraw FT issued into that PUT.View glossary entry UIUIThe visual interface through which users interact with an app or product.View glossary entry before sending funds.

When your contribution settles, your FT is issued as a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entryPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry that grants a standing on-chain ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entryExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par right to your primary-issued FT. You can Hold, Exit, or Withdraw, whichever best fits your plan or reaction to market conditions.

Your Perpetual PUT Position - How Does it Work?

Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry lifecycle.

Market buyers: FT purchased on the open market does not include a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry. The Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry is attached only to FT issued to primary contributors during the Private and Public Sale.

Note: You can trade Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entryPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry Options on the ftPUT Marketplace.

When your contribution mints FT, that FT is locked into your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry. From there, you always have three choices (and you can mix them over time in any proportions you like):

1. Hold: Keep your position and capital protection active

Do nothing and keep your ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry right. You participate in all FT appreciation while maintaining the ability to ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par whenever you choose. There are no trigger dates, no cliffs, the right is evergreen.

2. ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry: Exit at par for your original asset

ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry some or all of the exact asset and amount you originally committed. Exits can be partial and repeated.

Par asset return. ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par returns the same asset and the same amount you originally contributed.

So if you contributed 1,000 USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry and received a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry with 10,000 FT, then you can ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par for 1,000 USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry.

Or, if you contributed 2 ETH (1 ETH = $3,840) and received a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry with 76,800 FT, then you can ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par for 2 ETH.

Note: You get back the exact asset and amount you originally put in.

3. Withdraw: Access your FT and destroy your Perpetual PUT

If you want to directly hold, trade, or use your FT, you can withdraw it.

Note: Withdraw invalidates the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry on that portion forever.

The original backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry reserved for your ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par is released and used by the protocol for market buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry, benefiting everyone who remains.

Exit vs. Withdraw

Note: FT bought on the open market does not include a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry.

ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry (ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par): You get back the exact asset and amount you originally put in. Your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry is used on that portion, and the backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry is returned to you (no buyback).

Withdraw (Unlock FT): You take a portion or all of your FT out of the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry but your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry on that portion is invalidated. The reserved backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry is released and used by the protocol to fund market buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry of FT.

Note: Withdraw triggers buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry funded by the released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry.

USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry Example: ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par: Contribute 1,000 USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry → receive 10,000 FT. Later ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par with 10,000 FT → receive 1,000 USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry.

USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry Example: Withdraw & sell above par: Contribute 1,000 USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry → receive 10,000 FT. Withdraw 10,000 FT (PUT invalidated), then sell on the market at, say, $0.15; the released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry is used by the protocol to fund market buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry of FT over time.

ETH Example: ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par: Contribute 2 ETH → receive 76,800 FT (1 ETH = $3,840). Later ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par with 76,800 FT → receive 2 ETH.

ETH Example: Withdraw & sell above par: Contribute 2 ETH → receive 76,800 FT (1 ETH = $3,840). Withdraw 76,800 FT (PUT invalidated), then sell on the market at, say, $0.15; the released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry is used by the protocol to fund market buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry of FT over time.

Note: You get back the exact asset and amount you originally invested.

Illustrative scale effects. If a meaningful share of holders withdraw, released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry can retire large amounts of FT via buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry. For example, at a $0.10 average buyback price, $100m of released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry can retire roughly 1.0 billion FT; $250m can retire ~2.5 billion FT; $500m can retire ~5.0 billion FT.

Selling or transferring FT

To sell or transfer FT you first withdraw it from your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry. Withdraw permanently invalidates the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry on that portion. The backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry that had been reserved for your ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par is released to fund market buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry of FT. The buyer on the market does not receive a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry.

Distributions to users

A portion of protocol revenue/fees is used to buy FT on the market and distribute those tokens to users as defined by product‑level programs (separate from burns). Exact shares and schedules are shown in each product’s UIUIThe visual interface through which users interact with an app or product.View glossary entry and on the Token page. Revenue‑funded burns still govern Foundation/Team/Incentives unlocks (40:40:20).

Where Your Capital Goes

Contributed capital allocationcapital allocationThe on-chain Public Sale event where contributors exchange accepted assets for FT at a fixed rate (10 FT per $1). FT is allocated from a fixed pre-minted total supply of 10B. totalSupply stays 10B while the split between circulating and non-circulating supply changes.View glossary entry flow.

Less Risk. More Transparency.

Backing capitalBacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry itself is never spent. While your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry is open, contributed assets are kept liquid and deployed to low‑risk on-chain yield with no leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry and no bridgingno bridgingBacking capital remains on the source chain and is not bridged as part of the default allocation policy.View glossary entry (e.g., AaveAaveA decentralized lending protocol used for conservative yield and collateralization in several Flying Tulip flows.View glossary entry v3 for major stables, stETHstETHA liquid‑staking representation of ETH used for conservative staking yield.View glossary entry for ETH, jupSOLjupSOLA liquid‑staking representation of SOL used for staking yield in conservative allocations.View glossary entry for SOL, AVAXAVAXAvalanche’s native token and its wrapped ERC‑20 representation used for staking and liquidity.View glossary entry staking for AVAXAVAXAvalanche’s native token and its wrapped ERC‑20 representation used for staking and liquidity.View glossary entry, sUSDesUSDeA yield‑bearing form (sUSDe) and its base asset (USDe) used in certain strategies and as accepted assets in the PCA.View glossary entry for USDeUSDeA yield‑bearing form (sUSDe) and its base asset (USDe) used in certain strategies and as accepted assets in the PCA.View glossary entry). This keeps the program conservative and unwind‑friendly. Prioritizing safety and liquidity may result in lower yields than riskier strategies, by design, so that Exits at par can be honored quickly in all conditions.

Priority of backing capital yieldbacking capital yieldYield generated by deploying backing capital into low‑risk venues. Priority is to fund ecosystem development first (salaries/marketing/infra/ops); surplus funds buyback-and-burn of FT.View glossary entry:

- Ecosystem development first. The first call on the backing capital yieldbacking capital yieldYield generated by deploying backing capital into low‑risk venues. Priority is to fund ecosystem development first (salaries/marketing/infra/ops); surplus funds buyback-and-burn of FT.View glossary entry is to fund the ongoing development of the ecosystem, infrastructure and operations.

- All surplussurplusBacking capital yield remaining after the ecosystem budget; the surplus is used for buyback-and-burn.View glossary entry to buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry. Any remaining backing capital yieldbacking capital yieldYield generated by deploying backing capital into low‑risk venues. Priority is to fund ecosystem development first (salaries/marketing/infra/ops); surplus funds buyback-and-burn of FT.View glossary entry after the ecosystem budgetecosystem budgetThe first call on backing capital yield to fund the organization: salaries, marketing, infrastructure, and operations.View glossary entry is met is used for continuous buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry of FT.

Protocol revenue and fees from Flying Tulip’s entire suite of products (ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry, settlement rails, lending, derivatives, spot, permissionless markets, insurance) are also routed to buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry; and govern the unlocking of Foundation/Team/Incentives allocations using a 40:40:20 split.

- Buyback-and-burnBuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry funded by revenue unlock.

- Buyback-and-burnBuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry funded solely by backing capital yieldbacking capital yieldYield generated by deploying backing capital into low‑risk venues. Priority is to fund ecosystem development first (salaries/marketing/infra/ops); surplus funds buyback-and-burn of FT.View glossary entry does not trigger unlocks.

For the full backtests, formulas, and sensitivity math, see the Technical Appendix.

Safety first (and the trade‑off):

Backing capitalBacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry is kept in safesafeA multisig smart‑contract wallet commonly used for admin or treasury control.View glossary entry, liquid positions (no leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry, no bridgingno bridgingBacking capital remains on the source chain and is not bridged as part of the default allocation policy.View glossary entry) so Exits at par can be honored quickly. This may result in a lower yield than riskier strategies, by design. In synchronized ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry waves, some positions (e.g., LSTLSTA tokenized claim on staked assets that remains liquid (e.g., stETH).View glossary entry withdrawals) can introduce timing delays; we size and diversify to minimize this.

Unlock Mechanics

Unlocks are revenue‑linked. Buyback-and-burnBuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry funded by project revenue unlocks Foundation/Team/Incentives 1:1 (40:40:20). Buyback-and-burnBuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry funded only by backing capital yieldbacking capital yieldYield generated by deploying backing capital into low‑risk venues. Priority is to fund ecosystem development first (salaries/marketing/infra/ops); surplus funds buyback-and-burn of FT.View glossary entry does not unlock anything; they just reduce supply.

How to Participate

- Visit flyingtulip.com and connect a supported wallet.

- Choose an accepted asset (addresses below) and contribute to the Investment Contract.

- Receive FT at 10 FT per $1 contributed, issued into your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry.

- Manage your position over time: Hold, ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry, or Withdraw, all on-chain and reflected in the public buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry ledger.

Why This Structure Works

100% Capital Protection.

The structure is designed to reduce investor risk, preserve capital, and align incentives:

- The Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry or evergreen ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par right provides a floor at par, with no cliffs or lockups

- Backing capitalBacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry works continuously in conservative strategies rather than being spent, so that yield accrues immediately

- Revenue-linked operations and costs ensure team and foundation liquidity expands only when real cash flow is buying back FT, not up front

- Withdrawals create path‑dependent scarcity: released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry funds additional buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry for the benefit of remaining holders.

Risks to understand

- Liquidity timing during stress. Some backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry positions (e.g., stETHstETHA liquid‑staking representation of ETH used for conservative staking yield.View glossary entry, jupSOLjupSOLA liquid‑staking representation of SOL used for staking yield in conservative allocations.View glossary entry, AVAXAVAXAvalanche’s native token and its wrapped ERC‑20 representation used for staking and liquidity.View glossary entry) may require exitexitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry queuesqueuesWaiting periods required to withdraw from certain staking positions (e.g., stETH withdrawals, SOL/AVAX unbonding).View glossary entry or unbonding. Exposures are sized for timely unwinds, but synchronized exits can still slow settlement.

- Peg/basisbasisThe long/short spread or periodic payments that keep derivative prices aligned with spot (used in delta‑neutral strategies and futures).View glossary entry and yield variability. Components like sUSDesUSDeA yield‑bearing form (sUSDe) and its base asset (USDe) used in certain strategies and as accepted assets in the PCA.View glossary entry (basisbasisThe long/short spread or periodic payments that keep derivative prices aligned with spot (used in delta‑neutral strategies and futures).View glossary entry/funding dependent) and newer stables can experience yield compression or adverse basisbasisThe long/short spread or periodic payments that keep derivative prices aligned with spot (used in delta‑neutral strategies and futures).View glossary entry moves.

- Protocol/validator risk. Smart‑contract, validator, and MEVMEVValue extracted by transaction ordering, inclusion, or exclusion within a block.View glossary entry‑economics risks exist in all integrated systems (AaveAaveA decentralized lending protocol used for conservative yield and collateralization in several Flying Tulip flows.View glossary entry, LSTs, staking).

- Regulatory risk. Policy changes around stablecoins and staking can affect the backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry mix or operations.

- Investor trade‑offs. Secondary buyers do not receive a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry. Primary buyers who hold near-par for long periods may incur opportunity costs relative to higher‑risk strategies.

- ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry timing. In heavy ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry windows, some backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry components (e.g., LSTLSTA tokenized claim on staked assets that remains liquid (e.g., stETH).View glossary entry exits, validator unbonding) can introduce delays. Allocations are sized for fast unwinds, but synchronized exits can still slow settlement

Note: This page is informational and not investment advice. Yields are variable and not guaranteed.

Accepted Assets & Chains

Note: Always confirm these addresses in the InvestInvestDeposit accepted assets to open a PUT position and withdraw FT issued into that PUT.View glossary entry UIUIThe visual interface through which users interact with an app or product.View glossary entry at the time of contribution.

Ethereum

| Token | Address |

|---|---|

| USDTUSDTStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0xdAC17F958D2ee523a2206206994597C13D831ec7 |

| USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48 |

| USDSUSDSStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0xdC035D45d973E3EC169d2276DDab16f1e407384F |

| USDtbUSDtbStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0xC139190F447e929f090Edeb554D95AbB8b18aC1C |

| USDeUSDeA yield‑bearing form (sUSDe) and its base asset (USDe) used in certain strategies and as accepted assets in the PCA.View glossary entry | 0x4c9EDD5852cd905f086C759E8383e09bff1E68B3 |

| WETH | 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2 |

Avalanche

| Token | Address |

|---|---|

| wAVAXwAVAXAvalanche’s native token and its wrapped ERC‑20 representation used for staking and liquidity.View glossary entry | 0xB31f66AA3C1e785363F0875A1B74E27b85FD66c7 |

| USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0xB97EF9Ef8734C71904D8002F8b6Bc66Dd9c48a6E |

| USDTUSDTStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0x9702230A8Ea53601f5cD2dc00fDBc13d4dF4A8c7 |

Sonic

| Token | Address |

|---|---|

| wSwSSonic chain’s token and its wrapped/staked variants referenced in certain strategies and accepted‑assets lists.View glossary entry | 0x039e2fB66102314Ce7b64Ce5Ce3E5183bc94aD38 |

| USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0x29219dd400f2Bf60E5a23d13Be72B486D4038894 |

Base

| Token | Address |

|---|---|

| USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | 0x833589fCD6eDb6E08f4c7C32D4f71b54bdA02913 |

| WETH | 0x4200000000000000000000000000000000000006 |

BNB Chain

| Token | Address |

|---|---|

| WBNB | 0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c |

Solana

| Token | Address |

|---|---|

| USDCUSDCStablecoins accepted in PCA contributions and used across products; each has distinct risk/peg mechanics.View glossary entry | EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v |

| wSOL | So11111111111111111111111111111111111111112 |

FAQ

Do I have a lockuplockupA period during which tokens cannot be transferred or withdrawn.View glossary entry?

No. There is no vestingvestingA schedule that releases tokens over time instead of all at once.View glossary entryvestingA schedule that releases tokens over time instead of all at once.View glossary entry and no cliffcliffA vesting structure where tokens remain locked until a specific date, then begin unlocking.View glossary entrycliffA vesting structure where tokens remain locked until a specific date, then begin unlocking.View glossary entry. Your FT is issued into your Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry; you can Hold, Exit, or Withdraw at any time.

What’s the difference between ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry and Withdraw?

ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry at par returns your original asset. Withdraw unlocks your FT (Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry invalidated) and uses the released backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry to buy back and burn FT on the market.

Do buybacks always unlock tokens for the team/foundation?

No. Only revenue‑funded buybacks unlock Foundation/Team/Incentives (40:40:20) one‑for‑one. Backing capital yieldBacking capital yieldYield generated by deploying backing capital into low‑risk venues. Priority is to fund ecosystem development first (salaries/marketing/infra/ops); surplus funds buyback-and-burn of FT.View glossary entry‑only buybacks do not trigger unlocks.

Where can I see the math?

See the Technical Appendix (link below) for full backtests, formulas, and scenario tables.

Do I need a vote to ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry?

No. The Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry is an on-chain, programmatic right. Exercising it requires no governance vote, and a vote cannot revoke the right on existing primary-issued FT.

What is the difference between ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry vs. Withdraw?

ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry returns the exact asset and amount you originally committed at par.

Withdraw invalidates the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry; the reserved backing capitalbacking capitalThe contributed assets that back each primary FT position while the Perpetual PUT remains open.View glossary entry is then used by the protocol to fund market buyback-and-burnbuyback-and-burnA mechanism that buys FT on the open market and sends it to an irrecoverable address, permanently reducing supply. May be funded by backing capital yield surplus, protocol revenue/fees, or released backing capital from withdrawals.View glossary entry of FT. Buyers of FT on the market do not receive a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry

Do secondary buyers receive the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry?

FT purchased on the open market does not include a Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry. Only primary FT issued in the Capital AllocationCapital AllocationThe on-chain Public Sale event where contributors exchange accepted assets for FT at a fixed rate (10 FT per $1). FT is allocated from a fixed pre-minted total supply of 10B. totalSupply stays 10B while the split between circulating and non-circulating supply changes.View glossary entry has the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry

Why withdraw instead of ExitExitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry?

If FT trades above your original price, withdrawing and then selling can yield more than par, but you lose the Perpetual PUTPerpetual PUTThe on-chain right attached to primary-issued FT that lets a holder: Hold (keep the FT NFT attached), Exit (Exit at par; return collateral), or Withdraw (unlock FT; invalidate the PUT; released backing capital can fund market buyback-and-burn of FT).View glossary entry on the amount you withdraw. Exiting always returns exactly par, regardless of market price.

Footnotes

-

You exchange accepted on-chain assets for FT at a fixed rate of 10 FT per $1

(implied price: $0.10) ↩