Futures

Product Overview

Perpetual futuresPerpetual futuresFutures without expiration; Flying Tulip uses on‑chain trading as the primary price source with sub‑second settlement and funding tied to real borrowing costs.View glossary entry let you trade with leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry without an expiry date. In most venues, the contract's price follows an external oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry: a feed that updates every few seconds and decides who is liquidated and who is safesafeA multisig smart‑contract wallet commonly used for admin or treasury control.View glossary entry. FT Futures takes a different path. Instead of borrowing prices from somewhere else, it uses its own trading (Spot) as the source of truth. The contract settles to what actually trades here, not to a delayed print from elsewhere. That single design choice removes a familiar class of oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry lag and manipulation risk, and it changes how everything feels: quotes are live, settlements are sub‑500 ms, and liquidations key off prices you can really hit.

How perpetuals work in crypto: and what breaks

A perpetual future (or "future") is a leveraged product that mirrors spot exposure with no expiry. Longs and shorts pay each other a funding ratefunding ratePeriodic payments between long/short positions that keep future prices aligned with spot; can be computed from actual borrowing costs.View glossary entry that nudges the future back toward spot. On most platforms, "spot" is whatever the oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry says. That introduces two problems. First is latency: the oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry ticks every few seconds, so fast markets can move before the feed catches up. Users get liquidated on stale prices, and recovery is messy. Second is surface area: any integration error, governance bottleneck, or upstream hiccup in the oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry can ripple into your position. You pay for that risk in higher costs and fewer listed markets.

FT Futures turns the model inside‑out: it doesn't ask a third party for the price. It observes its own order flow. If ETH changes hands at $1,800 on the Spot, that is the settlement price. There is nothing to wait for.

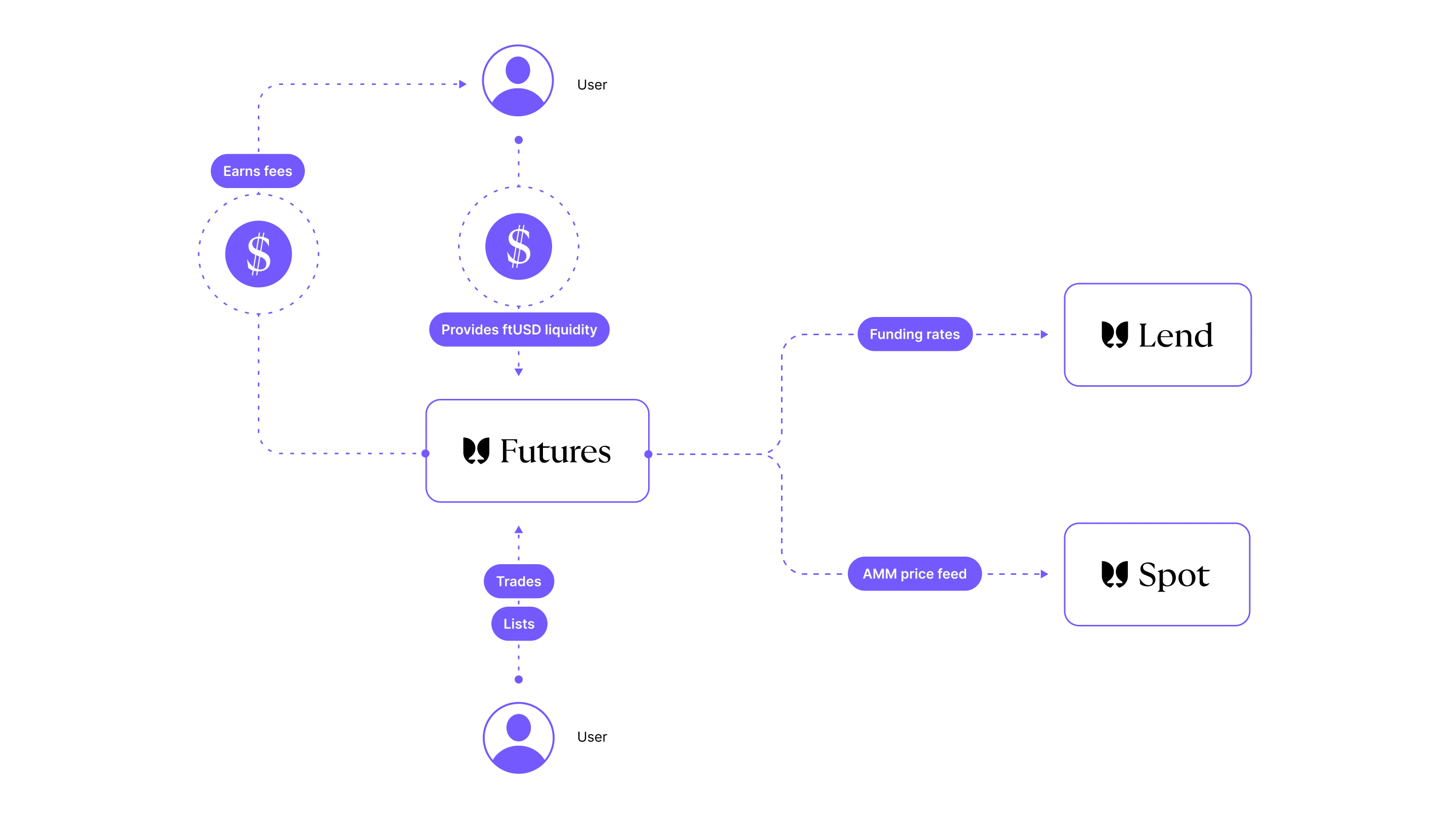

Futures interconnection with Spot and Lend

The Spot is the oracle: prices and depth, not just prints

Pricing begins with the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entryAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry adaptive curve and the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry resting orders. Together, they define where size can actually clear right now. The system looks beyond a single last trade. It maintains a TWAPTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entry (time‑weighted average price) for a clean time series and a TWARTWARA depth‑aware measure used in futures that considers how much of X can be sold for Y over time, enabling safer leverage and funding calculations.View glossary entry‑family of depth‑aware measures that ask a more practical question: how much of X can be sold for Y over this window without punching through reserves? Those depth‑aware windows drive the mechanics that matter: maximum leverage, liquidation sizing, and slippage guards. You are not leveraged against a number that only small trades can hit; you are leveraged against what the pool can truly absorb.

Because price discovery is internal, settlements are near‑instant. There is no 2–5s oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry tick to wait for, so liquidations are far less likely to trip on lag. And because the same engine sets prices and absorbs liquidations, unwinds can be sized to depth instead of blasted into a vacuum.

Collateral and leverage: cross‑collateral when you want it

Futures can run in isolated or cross‑collateralcross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entry modes. In isolated mode, you post collateralcollateralAssets allowed as collateral and the maximum per‑asset size configured to manage concentration and risk.View glossary entry for a specific market and keep risk ring‑fenced. In cross‑collateralcross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entry mode (via the permissioned Lend pool), a single deposit backs futures, CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry orders, and borrowing at once. Your idle collateralcollateralAssets allowed as collateral and the maximum per‑asset size configured to manage concentration and risk.View glossary entry is not idle: it continues to accrue its underlying money‑market yield while it backs trades. Maximum leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry is not a fixed table; it reflects depth and volatility from TWARTWARA depth‑aware measure used in futures that considers how much of X can be sold for Y over time, enabling safer leverage and funding calculations.View glossary entry windows and contracts when conditions thin. When you open or adjust a position, limits are snapshotted so the rulebook doesn't change retroactively while you are holding.

Liquidations that respect the market

When a position needs to be trimmed, the engine simulates the next clip on the AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry's curve and checks it against guardrails. If the clip would push beyond safesafeA multisig smart‑contract wallet commonly used for admin or treasury control.View glossary entry impact, the sale is time‑sliced into smaller steps, often crossing any resting CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry liquidity first, then walking the AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry. KeepersKeepersExternal actors incentivized to execute liquidations or complex unwinds. Flying Tulip uses size/time‑sliced execution and rebates to reduce market impact.View glossary entry are paid for low‑footprint execution, not for slamming markets. In quiet conditions, liquidations resolve in one or two clips; in fragile conditions, they step down a staircase. The aim is simple: protect solvency without turning stress into a spiral.

Funding that makes economic sense

Funding exists to pull the future back toward the spot. FT Futures anchors funding to actual borrowing costs and market imbalances seen in the Lend markets and the Spot, not to an external guess. When longs are effectively borrowing dollars to hold coin, and that borrowing is expensive, funding reflects it. When shorts crowd the other side, funding flips. You can see the inputs, the update cycle, and why you paid (or got paid) what you did.

Who takes the other side: opt‑in settlement LPs

Futures need a counterparty at settlement. FT handles this with opt‑in settlement pools. Liquidity providers deposit ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry and volunteer to settle trades in return for per‑settlement fees (around 0.05% per settlement, subject to policy). Exposure is balanced across providers, and providers can adjust or withdraw from the pool, subject to pool parameters. This design means no one is forced into risk they don't want, and new markets can launch when there is Spot liquidity and enough ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry settlement supply, not when an oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry committee has time to integrate a feed.

Note: ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry is the settlement currencysettlement currencyftUSD is used as the settlement currency; opt‑in LPs deposit ftUSD to settlement pools and accrue fees.View glossary entry. Holding ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry on its own does not pay yield; staking to sftUSDsftUSDStaked ftUSD receipt token that accrues the staking pool’s yield.View glossary entry does. Settlement LPs accrue Futures fees by opting into settlement pools; this is distinct from sftUSDsftUSDStaked ftUSD receipt token that accrues the staking pool’s yield.View glossary entry yield.

How it fits the rest of Flying Tulip

Futures sit on top of the same pricing spine as everything else. It references Spot windows for price and depth, uses Lend for cross‑collateralcross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entry and portfolio health, and settles in ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry. Because Flying Tulip is token‑first, a share of futures revenue participates in the FT buyback pipeline, and the revenue‑linked unlocks described in the FT overview. The result is a loop: trading activity funds the token economy that, in turn, helps deepen the markets you trade.

What it feels like to trade

You pick an asset, choose isolated or cross‑collateralcross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entry, and set leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry. The route preview shows the expected impact and your funding context. Orders are matched on the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry when you want precision, or crossed against the Spot when you want immediate certainty; most flows use both. Your position updates against live prices (no oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry tick to wait for), and your collateralcollateralAssets allowed as collateral and the maximum per‑asset size configured to manage concentration and risk.View glossary entry health moves with what actually trades. If the market turns, the liquidationliquidationForced unwind of risky positions; Flying Tulip emphasizes gradual "soft" liquidations via Spot routing, with size/time‑slicing and keeper incentives.View glossary entry engine trims exposure in measured steps. When conditions are calm, your fills feel like a centralized exchange. When they are not, the system is built to be conservative first and clever second.

Fees and where they go

Futures charge trading fees and funding transfers between longs and shorts. Settlement LPs accrue a per‑settlement fee for providing ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry to the settlement pools. A protocol fee may be taken where policy allows; that portion flows into the FT buyback pipeline (and, when revenue‑funded, into the token‑unlock logic). Nothing here promises a fixed rate: fees and funding are variable and transparent, tied to realized activity and risk.

Risks to understand

LeverageLeverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry amplifies outcomes. Depth can thin under stress, spreads can widen, and liquidations can still occur. Internal pricing removes a class of oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry risk but not market risk. Smart contracts and integration risks are inherent to DeFiDeFiFinancial services built on public blockchains using smart contracts rather than centralized intermediaries.View glossary entry, and cross‑collateralization introduces portfolio‑level interactions that you should understand before you size up. The Risks, Security & Audits page explains our controls (guardrails, pausingpausingTemporarily halting token transfers or protocol operations via admin roles for safety.View glossary entry, caps, monitoring) and what users can do to protect themselves.

How‑to (overview)

Open a future position. Choose isolated or cross‑collateralcross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entrycross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entry, post collateralcollateralAssets allowed as collateral and the maximum per‑asset size configured to manage concentration and risk.View glossary entrycollateralAssets allowed as collateral and the maximum per‑asset size configured to manage concentration and risk.View glossary entry, set leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entryleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry, and place a market or limit order. Review your snapshotsnapshotA point‑in‑time capture of on‑chain state used to determine whitelist eligibility.View glossary entry limits and funding context before confirming.

Manage collateral. Add or remove collateral, reduce size, or close the position. Adjusting re‑snapshots limits under current conditions.

Provide settlement liquidity. Deposit ftUSD into a futures settlement pool to accrue per‑settlement fees. Monitor pool parameters (utilization, fee schedule) and adjust or withdraw as policy allows.

FAQs

Without external oracles, what stops manipulation?

Attackers would need to move actual on‑platform liquidity. Pre‑trade guardrails, depth‑aware windows (TWARTWARA depth‑aware measure used in futures that considers how much of X can be sold for Y over time, enabling safer leverage and funding calculations.View glossary entry family), dynamic fees, and time‑sliced executiontime‑sliced executionBreaking a large unwind into smaller pieces over time to reduce price impact.View glossary entry raise the cost of forcing prices where depth doesn't support it. No system is risk‑free, but the incentives target practical, executable prices.

How fast are settlements, really?

Settlements are sub‑second (targeting sub‑500 ms) because prices come from our own Spot. There is no oracleoracleExternal feed of asset prices. Flying Tulip futures derive pricing/settlement from in‑house trading activity to avoid oracle lag/manipulation.View glossary entry tick to wait for.

What determines my maximum leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry?

Depth and volatility. The engine reads TWARTWARA depth‑aware measure used in futures that considers how much of X can be sold for Y over time, enabling safer leverage and funding calculations.View glossary entry/TWAPTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entry windows and sets leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry to size your position against what the market can absorb. As conditions change, new openings/adjustments get new snapshots.

Do settlement LPs take directional risk?

They provide ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry to settle trades and accrue per‑settlement fees. Exposure is diversified across providers and managed by a pool policy. LPs can adjust or withdraw, subject to parameters.

Does ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry pay yield by itself?

No. ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry is the settlement currencysettlement currencyftUSD is used as the settlement currency; opt‑in LPs deposit ftUSD to settlement pools and accrue fees.View glossary entry and is non‑yielding by default. If you want yield, stake ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry to sftUSDsftUSDStaked ftUSD receipt token that accrues the staking pool’s yield.View glossary entry. Settlement LPLPA user who deposits assets into a pool or AMM to accrue fees or incentives.View glossary entry fees are a separate earnings path tied to futures activity.

What happens in thin markets?

LeverageLeverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry limits contract, fees can rise, and the liquidationliquidationForced unwind of risky positions; Flying Tulip emphasizes gradual "soft" liquidations via Spot routing, with size/time‑slicing and keeper incentives.View glossary entry engine relies more heavily on slicing and routing through any resting CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry liquidity. In extreme conditions, circuit breakers and policy caps apply.

Related pages

- FT Spot: the adaptive curve, TWAPTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entry/RWAPRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entry, and routing with the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry

- FT Lend: cross‑collateralcross‑collateralUsing one deposit as collateral across multiple markets or products simultaneously (e.g., lending, CLOB, futures).View glossary entry, snapshot LTVsnapshot LTVBorrow limits fixed at the time of opening/adjustment to protect users from abrupt parameter changes.View glossary entry, and soft liquidations

- ftUSD: settlement currencysettlement currencyftUSD is used as the settlement currency; opt‑in LPs deposit ftUSD to settlement pools and accrue fees.View glossary entry and the distinction between ftUSDftUSDA delta‑neutral, yield‑bearing stable asset designed to target $1 while minimizing liquidation risk by balancing long/short exposures (e.g., supply/stake/borrow loops).View glossary entry and sftUSDsftUSDStaked ftUSD receipt token that accrues the staking pool’s yield.View glossary entry

- FT: token‑first revenue flows and buyback pipeline

- Risks, Security & Audits: platform‑wide risks and controls

- How‑to Guides: Open/Close a Future, Manage CollateralCollateralAssets allowed as collateral and the maximum per‑asset size configured to manage concentration and risk.View glossary entry, Provide Settlement Liquidity (coming soon)