Spot

Product Overview

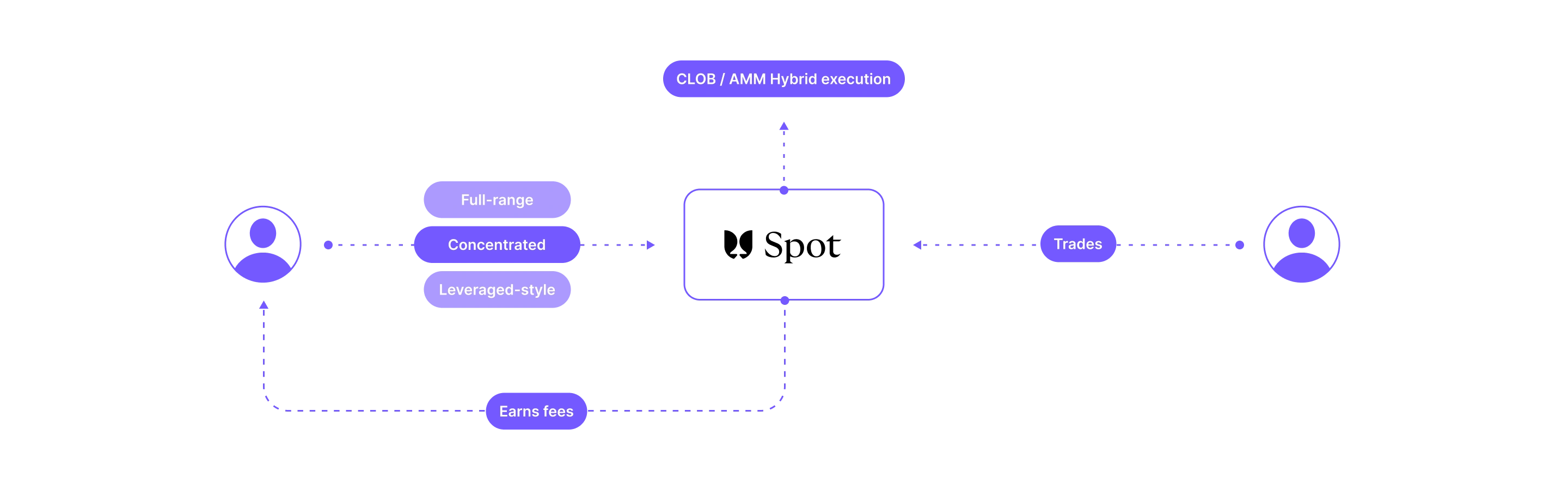

Flying Tulip's Spot is the ecosystem's trading engine and price source. It is the venue where swaps clear, where liquidity is supplied, and where the system takes its cues for pricing, funding, and risk. Instead of fixing one curve and hoping markets behave, the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry adapts in real time. In quiet conditions, it aims to achieve spreads that feel close to those of a professional market makermakerTrading roles where makers add liquidity with resting orders and takers remove it by trading against them; fee schedules often differ.View glossary entry. When volatility arrives, it adds curvature to cushion impact and protect liquidity providers. Alongside the AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry, a CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry (central limit order bookorder bookSee CLOB; orders can rest while deposits continue to accrue in the permissioned lending system.View glossary entry) accepts resting limit orders. Trades can clear entirely on the AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry, entirely through the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry, or across both; whichever produces the best executable price for the size at hand.

Spot: adaptive AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry and CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry.

A market that changes with the weather

Conventional AMMs commit to a single formula, typically the constant productconstant productAMM curve archetypes: x·y = k (constant product) offers LP protection with higher price impact; x + y = k (constant sum) offers tight spreads with less protection. Flying Tulip blends them dynamically.View glossary entry model. That is robust but can be wasteful in calm markets, and it still leaves LPs exposed when prices trend. The FT Spot blends behaviors instead of choosing one. In stable regimes, the curve leans toward constant‑sum, so prices barely move for modest flow; the experience is tight spreads and low slippageslippageThe difference between expected and executed price due to trade size and available liquidity.View glossary entry. As dispersion increases, the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry tilts toward constant‑product, so each marginal unit moves the price more. That extra curvature slows toxic flow and reduces divergence losses for LPs during stress. The transition is not binary. It is driven by smooth regime signals and bounded coefficients, so the curve slides rather than snaps from one extreme to the other.

Knowing when to shift

The Spot watches prices and flow and smooths what it sees with exponential moving averages. Those EMAs dampen overreaction to a single print while allowing the system to respond to genuine regime change. Guardrails cap how far and how fast the curve can move within any window, keeping the experience predictable for both traders and LPs. The result is an engine that responds to conditions without becoming twitchy.

Prices you can actually trade at

A time‑weighted average (TWAPTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entryTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entry) is useful, but it is blind to depth. The Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry also maintains a reserve‑weighted view (RWAPRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entry), which weights each price observation by the liquidity available along the likely execution path. RWAPRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entry answers a practical question, what price can this order size actually clear?, and is more informative for routing and for evaluating realized impact. Downstream systems can also reference depth‑aware measures (such as reserve‑weighted windows) when sizing liquidations, setting leverage limits, or computing funding for futures.

What it feels like to trade

When you request a swap, the router looks at both books. If there are limit orders resting on the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry at a better price, those are swept first. Any remainder is filled against the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry at the current adaptive curve. Before the transaction is finalized, the router simulates the trade on‑chain to assess its impact on your slippageslippageThe difference between expected and executed price due to trade size and available liquidity.View glossary entry tolerance and the pool's risk guardrails. If a single clip would be too heavy, the order can be split and time‑sliced so it walks through depth more gently. Fees are shown up front and vary with regime; lighter in calm conditions to encourage flow, heavier in turbulence to compensate LPs and slow informed bursts. The receipt shows how much moved through the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry, how much crossed the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry, and what fees were paid.

What it feels like to provide liquidity

If you want to accrue fees, you can allocate assets in a way that aligns with your attention and risk tolerance. A full‑range position is the simplest: you deposit both sides, and the AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry spreads them across the entire price domain. You will always be in range, you will collect a steady share of fees, and you will still experience impermanent lossimpermanent lossThe divergence loss LPs can face when an AMM pool’s asset prices shift relative to deposit prices; mitigated by Flying Tulip’s hybrid curve behavior in volatile regimes.View glossary entry if the pair trends. If you want more fee density, you can concentrate liquidity into a band you choose. While the market lives inside your band, you accrue a higher fee share per unit of capital; if the price exits the band, you stop accruing until you rebalance.

LPLPA user who deposits assets into a pool or AMM to accrue fees or incentives.View glossary entry returns are generated by trade fees and any programmatic incentives displayed in the interface. Fees accrue continuously into the pool's accounting, and you can add or remove liquidity or adjust bands at any time, subject to pool policies. All of the usual AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry caveats apply: if the pair drifts, your assets rebalance; if the market runs, concentrated bands need managing. The goal of the adaptive curve is not to eliminate those realities but to make them kinder; tighter prices when it is safesafeA multisig smart‑contract wallet commonly used for admin or treasury control.View glossary entry, more protection when it is not.

Fees that make sense

Fixed fees ignore context. The AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry treats fees as a policy instrument. In quiet regimes, the schedule approaches its lower bound, encouraging users to route flow here rather than elsewhere. As volatility and toxicity rise, the schedule climbs toward its upper bound so LPs are paid appropriately, and flow slows to a sustainable pace. Bounds and sensitivity are public.

Safety before speed

Every swap proposal is simulated against the live curve before state changes are applied. If the simulation shows the trade would breach pool guardrails - too much impact, too shallow reserves, too close to configured limits - the router refuses the transaction. For large orders, the system can slice clips over blocks to reduce the footprint. The idea is to be fast in all the ordinary moments and conservative in the rare ones that break people.

How the Spot's AMM fits the rest of Flying Tulip

The Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry is more than a place to swap. Its prices and depth windows are the foundation for the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry, which provides limit‑order precision on top of continuous liquidity. The futures system takes its funding and risk cues from the Spot prices and depth rather than relying on external oracles. The lending markets lean on Spot depth to perform soft, size‑aware liquidations that minimize market impact and commit LTV ratios based on available size. The insurance primitive uses Spot‑anchored windows for transparent valuations and event checks. And because Flying Tulip is token‑first, a share of the revenue generated here flows into the FT buyback pipeline described in the FT overview.

Using it day to day

If you are swapping, you will see a single route preview. Sometimes everything fills on the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry, sometimes everything crosses the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry, and often it is a blend. You choose a slippageslippageThe difference between expected and executed price due to trade size and available liquidity.View glossary entry tolerance; the router enforces it. If you are providing liquidity, you decide whether you want set‑and‑forget coverage, a concentrated band you will tend occasionally. The interface shows the current regime, the fee tier, and the band economics so you can decide whether now is a good moment to lean in, widen out, or step aside.

Understanding the trade‑offs

Adaptive design makes the experience smoother, not risk‑free. Impermanent lossImpermanent lossThe divergence loss LPs can face when an AMM pool’s asset prices shift relative to deposit prices; mitigated by Flying Tulip’s hybrid curve behavior in volatile regimes.View glossary entry still exists when pairs diverge. Concentrated bands pay more while they are in range and pay nothing when they are not. In stressed markets, spreads widen and fees increase; execution may be sliced to protect the pool. As with any on‑chain system, smart‑contract, integration, and MEVMEVValue extracted by transaction ordering, inclusion, or exclusion within a block.View glossary entry risks apply. The risk page of the documentation explains these in depth and describes the controls - role separation, caps, pausingpausingTemporarily halting token transfers or protocol operations via admin roles for safety.View glossary entry and circuit breakers, and change management - that sit around the engine.

If you want the short version: the Spot's AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry is built to behave like a thoughtful market makermakerTrading roles where makers add liquidity with resting orders and takers remove it by trading against them; fee schedules often differ.View glossary entry when the seas are calm, and like a cautious one when they are rough. It is the price reference for the rest of Flying Tulip and the place where liquidity is provided in a way that respects both sides of a trade.

How to LP (overview)

- Open Provide Liquidity on the pair you want.

- Choose Full‑range, Concentrated (set band), or Leveraged‑style profile.

- Review fee schedule, current regime, and projected fee density.

- Confirm deposit; receive LPLPA user who deposits assets into a pool or AMM to accrue fees or incentives.View glossary entry position representation (visible in the dashboard).

- Monitor P&LP&LNet gains or losses on a position after fees and price changes.View glossary entry (fees accrued minus IL). Adjust bands or exitexitAction that exercises the Perpetual PUT at par; the original asset/amount is returned.View glossary entry anytime.

How to Swap/Trade (overview)

- Open Swap/Trade.

- Select tokens and enter size; set slippageslippageThe difference between expected and executed price due to trade size and available liquidity.View glossary entry (and advanced options if needed).

- Review the route preview (estimated price, dynamic fee).

- Confirm; the router executes, slicing as needed.

- Review the receipt (final price, fee, realized impact).

Risks (summary)

- Impermanent lossImpermanent lossThe divergence loss LPs can face when an AMM pool’s asset prices shift relative to deposit prices; mitigated by Flying Tulip’s hybrid curve behavior in volatile regimes.View glossary entry (IL). More pronounced with trending divergence; mitigated (not eliminated) by adaptive curvature.

- Out‑of‑range risk. Concentrated liquidityConcentrated liquidityProviding AMM liquidity within a chosen price range to accrue higher fees while in range.View glossary entry accrues no fees when the price leaves the band until you rebalance.

- Execution risk. In stress, spreads widen and price impactprice impactSlippage caused by trade size relative to available depth; managed by hybrid curves and depth‑aware metrics.View glossary entry grows; dynamic fees also rise.

- Venue/contract risk. As with all DeFiDeFiFinancial services built on public blockchains using smart contracts rather than centralized intermediaries.View glossary entry, smart‑contract, integration, and MEVMEVValue extracted by transaction ordering, inclusion, or exclusion within a block.View glossary entry risks exist.

Note: Read Risks, Security & Audits for platform‑wide and capital‑allocation risk frameworks.

FAQs

Is this still an AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry if there's also a CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry?

Yes. The AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry provides continuous liquidity; the CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry provides limit‑order precision. The router can use both for the best execution.

Do I have to micromanage ranges?

No. Use full‑range for low‑maintenance exposure. If you want tighter fee density, choose concentrated and periodically rebalance.

What makes RWAPRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entry better than TWAPTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entry for large orders?

TWAPTWAPA time‑only averaging of price used in oracles and analytics; complements depth‑aware measures.View glossary entry averages over time; RWAPRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entry weights by available reserves near the path, so it approximates the price you'll actually get for size.

Can Spot prices be manipulated to affect Futures or Lend?

Pre‑trade guardrails, depth‑aware metrics (RWAPRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entryRWAPA price metric that weights observations by available reserves near the path of execution, providing a depth‑aware benchmark for swaps.View glossary entry/TWARTWARA depth‑aware measure used in futures that considers how much of X can be sold for Y over time, enabling safer leverage and funding calculations.View glossary entry), dynamic fees, and slicing are designed to resist short‑burst attacks. No system is risk‑free; see the risk page for details.

Related pages

- FT Token: token‑first flows and buyback pipeline

- ftUSD: how settlement currencysettlement currencyftUSD is used as the settlement currency; opt‑in LPs deposit ftUSD to settlement pools and accrue fees.View glossary entry and staking (sftUSDsftUSDStaked ftUSD receipt token that accrues the staking pool’s yield.View glossary entry) work

- Futures: how pricing/funding leverageleverageTrading with exposure greater than posted collateral; in FT futures, leverage constraints are set using depth‑aware metrics.View glossary entry Spot + CLOBCLOBAn exchange mechanism that matches bids and asks; integrated with Flying Tulip’s permissioned lending for cross‑collateralized trading while deposits continue to accrue.View glossary entry metrics

- Lend: soft liquidations and depth‑aware risk controlsrisk controlsGuardrails and procedures (e.g., regime detection, snapshot LTV, soft liquidation, size/time‑slicing, incentivized keepers) that aim to reduce tail risk and market impact.View glossary entry

- Risks, Security & Audits: general DeFiDeFiFinancial services built on public blockchains using smart contracts rather than centralized intermediaries.View glossary entry and AMMAMMOn‑chain market using formulas instead of a central order book to quote prices and execute swaps.View glossary entry‑specific risks

- How‑To Guides: Add/Remove Liquidity, Choose Ranges, Advanced Swap Routing (coming soon)